السبت، 13 فبراير 2016

الجمعة، 12 فبراير 2016

شاب بعلق مع واده زميلته ف الجامعه ويعلمها السكس من البدايه ويقولها لما يقابلها هينكها #سكس

شاب بعلق مع واده زميلته ف الجامعه ويعلمها السكس من البدايه ويقولها لما يقابلها هينكها #سكس

ساره الشرموطه بتتكلم مع خطيبها وتهيج وهو بيكلمها وتتناك ويسجلها ويتضحوا #سكس

ساره الشرموطه بتتكلم مع خطيبها وتهيج وهو بيكلمها وتتناك ويسجلها ويتضحوا #سكس

بنت جامده مولعه اوى بتكلمه بتقوله انا عايزه احضنك وانته بتلعب ف بزازى واهاتها نار #سكس

بنت جامده مولعه اوى بتكلمه بتقوله انا عايزه احضنك وانته بتلعب ف بزازى واهاتها نار #سكس

مكالمه شديده فشيخ لشاب ماسك بنت شديده اوى وهيجانه واهاتها مولعه نار #سكس

مكالمه شديده فشيخ لشاب ماسك بنت شديده اوى وهيجانه واهاتها مولعه نار #سكس

بنت هيجانه ببتكلم ف التليفون وتقوله زبرك هيوجعنى واهات عاليه تقطع الزبر #سكس

بنت هيجانه ببتكلم ف التليفون وتقوله زبرك هيوجعنى واهات عاليه تقطع الزبر #سكس

مكالمة جنسية لشرموطة تكلم عشيقها وتقوله كسي بيوجعنى عايزة زبك ربع ساعة من المتعة #سكس

مكالمة جنسية لشرموطة تكلم عشيقها وتقوله كسي بيوجعنى عايزة زبك ربع ساعة من المتعة #سكس

شاب ماسك خطيبته وتقوله ورا بيوجعنى وهو بيدخل واهاتها تهيج اجدع زبر #سكس

شاب ماسك خطيبته وتقوله ورا بيوجعنى وهو بيدخل واهاتها تهيج اجدع زبر #سكس

نتايه شابه كوسها نينتش عليها تكلم حبيبها ويسجلها واهاتها تهيج حصرى #سكس

نتايه شابه كوسها نينتش عليها تكلم حبيبها ويسجلها واهاتها تهيج حصرى #سكس

الجمعة، 22 يناير 2016

Industrial Production Numbers and Revisions Shockingly Bad; Autos Have Peaked

Not solely was Dec industrial production associate awful -0.4%, Nov was revised lower from -0.6% to -0.9%.

Not to worry, economists blame the weather for abundant of the decline.

The Econoday accord Estimates for industrial production and producing were -0.2% and +0.0% severally. the particular results were -0.4% and -0.1%.

December wasn't an honest month for the economic economy as industrial production fell a sharper-than-expected zero.4 percent. Utility output, down 2.0 percent, declined for a 3rd straight month reflective unseasonably heat temperatures. Mining, reflective low trade goods costs and contraction in energy extraction, has conjointly been week, down 0.8 p.c for a fourth straight decline. Turning to producing, that is that the most vital element during this report, production fell zero.1 p.c for a second straight month (November revised downward from associate initial no-change reading).

Details on producing embrace a second straight contraction for vehicles, down 1.7 p.c following November's one.5 p.c decline. Weakness here, in conjunction with weakness within the motorized vehicle element of this morning's retail sales report, can raise speak that the automobile sector, that had been one among the highlights of the 2015 economy, might bog down in 2016, a minimum of the first a part of the year. Construction provides area unit a positive, up 0.6 p.c for the second sturdy showing in 3 months and confirming strength current in information for construction payment.

Capacity utilization fell four tenths from a downward revised Nov to seventy six.5 percent. a coffee utilization rate, that is running roughly four proportion points below its long average, holds down the value of products.

Year-on-year rates ensure weakness, down 1.8 p.c overall with utilities down half-dozen.9 p.c and mining down eleven.2 percent. producing is within the and column however it's nothing spectacular, at plus 0.8 percent.

Making matters worse could be a downward revision to Nov, currently at minus zero.9 p.c vs associate initial decline of zero.6 percent. viewing the annualized rate for the fourth quarter, industrial production fell three.4 p.c although producing did increase however not abundant, up 0.5 percent. Weather factors area unit skewing utility output however otherwise, readings area unit essentially soft and replicate the downswing in international demand created a lot of severe for U.S. producers by strength within the dollar.

Index of business Production

It seems the weather has been dangerous for ten out of the last twelve months.

Industrial Production Numbers

Above table from the central bank Industrial Production and capability Utilization Report.

Spotlight on automobile Sector

For most of 2015, I had been expression that automobile sales weren't property. Over the past 2 months we tend to began to see solid proof of that viewpoint.

I commented on variable automobile reports, some good, some bad, on Jan five, in Dec U.S.A. New automotive Sales "Down, Exceptionally Weak" Says Bloomberg; WSJ Says Up and powerful.

Those expression Dec sales were sturdy did not take into thought the amount of commerce days.

Looking ahead, makers have spoken: Dec vehicle production was down one.7 p.c following November's one.5 p.c decline.

The last 5 months for automobiles and elements production seem like this: -5.1 August, +0.5% Sep, +1.1% October, -1.5% Nov, -1.7% Dec.

Autos have peaked.

Mike "Mish" Shedlock

الأربعاء، 20 يناير 2016

Shell Fires Another 10,000; Energy Layoffs Top 250,000; Oil Breaks $28 Again; In Search of Jobs

Shell Fires Another 10,000

As reflective of trends in the industry Shell Fires 10,000 Workers

The "BG combination" mention above but not explained (emphasis mine) refers to the Shell Takeover of BG announced in December.

Management is never fired for questionable, even outright bad, corporate decisions. Employees, not management takes the hit. In this case, chalk up another 10,000 employee synergies.

Energy Layoffs Pile Up

In Search of Jobs

On November 23, Houston Public Media reported Oil Workers Brace For Fresh Layoffs, As Industry Wrestles With ‘Lower For Longer’ Crude Prices

On November 20, Bloomberg noted Oil Jobs Cuts Top 250,000.

56,000 Layoffs in Texas Alone

On November 12, FuelFix reported Oil crash job losses in Texas may be steeper than previously thought.

Unambiguously Good

The price of US and Brent crud both broke $28 to the downside today but remain hovering near that level.

Don't fret. I have it on good authority this decline in oil prices is "Unambiguously Good" for the economy.

In a CNBC video in November of 2014, Kudlow stated Drop in Oil Prices is Unambiguously Good.

It was not just Kudlow making such statements. Various Fed officials believed the same thing.

"We Got This Wrong"

Let's now flash forward to a bit of reality. On January 9, 2016, San Francisco Fed president John Williams finally admitted "We Got This Wrong".

Williams still does not realize precisely what is wrong.

Oil prices in and of themselves are inherently neither good nor bad. It all depends on why. In this case, the Fed sent false economic signals with round after round of QE, and by once again keeping interest rates too low, too long.

Effects were not seen in consumer prices as the Fed wanted. Rather, asset price bubbles developed in stocks, bonds, and junk bond borrowings of hundreds of billions of dollars to drill wells smack into a slumping global economy.

The only "tools" the Fed knows are rates cuts and QE. But that's what created this mess. And here we sit with the Fed still insisting four more hikes are coming in 2016.

The market now spits in the Fed's face.

Mike "Mish" Shedlock

As reflective of trends in the industry Shell Fires 10,000 Workers

As its fortunes collapse due to falling oil prices, Royal Dutch Shell PLC will fire 10,000 people in an effort to bolster margins.Did Shell Overpay for BG?

Operating costs have reduced by $4 billion, or around 10% in 2015, and the company expects Shell’s costs to fall again in 2016 by a further $3 billion. Synergies from the BG combination will be in addition to that. Together, these actions will include a reduction of some 10,000 staff and direct contractor positions in 2015-16 across both companies, as streamlining and integration of the two companies continue.

The "BG combination" mention above but not explained (emphasis mine) refers to the Shell Takeover of BG announced in December.

Royal Dutch Shell is pressing ahead with its $60bn (£40bn) takeover of BG Group despite doubts among some shareholders about the deal’s viability given the falling oil price.Merger Rule Number One

Some Shell shareholders believe the company is paying over the odds for BG because the deal was agreed in April on the assumption that oil prices would recover to $90 a barrel by 2020. The price of oil has slumped from $115 a barrel in summer 2014 to less than $40. On Monday it dropped to an 11-year low of $36.17.

David Cumming, head of equities at Standard Life Investments, said last week the deal does not make sense with the oil price so low. He called on Shell’s boss, Ben van Beurden, to pay a $750m break fee to scrap the deal or renegotiate the terms. The only other option is for shareholders to vote against the takeover, he said.

Management is never fired for questionable, even outright bad, corporate decisions. Employees, not management takes the hit. In this case, chalk up another 10,000 employee synergies.

Energy Layoffs Pile Up

- July 28: Chevron to cut 950 jobs in Houston, 500 in San Ramon,500 companywide

- October 30: Chevron will lay off 6,000 to 7,000 workers, slash spending.

- December 14: Shell announces another 2,800 layoffs in 2016

In Search of Jobs

On November 23, Houston Public Media reported Oil Workers Brace For Fresh Layoffs, As Industry Wrestles With ‘Lower For Longer’ Crude Prices

“We’re seeing declines in population across these towns in south Texas,” says Ed Hirs, an energy economist at the University of Houston.Global Oil Layoffs Top 250,000

For nearly eight years, high-paying jobs grew at a blistering pace across the region, long one of the poorest in the state. Now companies are shutting down operations, and those jobs are vanishing. “And until the price returns to a level above $75, $85, $95 a barrel,” Hirs says, “we won’t see a complete reemployment of everybody who’s left.”

So people are leaving — not just south Texas, but the industry — in search of work. Some will come back when the price of oil recovers. But this is an industry where roughly 70 percent of the workforce is over age 50. That’s the legacy of weak hiring during the oil bust of the 1980s and 1990s.

“I think this is going to be an acute problem in a couple of years’ time. I think it’s going to come bite us extremely hard,” says Tobias Read, CEO of Swift Worldwide Resources, an energy recruiting firm based in Houston.

Two years ago, the energy sector’s big concern was a shortage of skilled workers. Companies were scrambling to train up a new generation of engineers and geologists, pipefitters and project managers, to replace those they were about to lose.

“They’ve spent a lot of time retaining, recruiting, and training talent,” says Chad Hesters, who runs the Houston office of recruiting firm Korn Ferry. “They don’t want to see that talent leave. It’s incredibly expensive to have people you’ve spent years training walk out the door.”

On November 20, Bloomberg noted Oil Jobs Cuts Top 250,000.

The number of jobs gutted from oil and gas companies around the world has now passed the 250,000 mark, with still more to come, according to industry consultant Graves & Co.The winner of the blue ribbon award for accurate prediction in the month of November goes to Graves for his understatement "It’s going to get worse before it gets better."

"I was surprised it’s gotten this far," John Graves, whose Houston firm assists in oil and gas deals with audits and due diligence, said Friday in a phone interview.

The industry has idled more than 1,000 rigs and slashed more than $100 billion in spending this year to cope with oil prices that have fallen by more than half since 2014. Oil services, drilling and supply companies are bearing the brunt of the downturn, having accounted for 79 percent of the layoffs, according to Graves.

56,000 Layoffs in Texas Alone

On November 12, FuelFix reported Oil crash job losses in Texas may be steeper than previously thought.

The number of oil and gas job losses in Texas may be far worse than an industry group originally predicted, potentially reaching 56,000, according to the latest analysis by the Texas Alliance of Energy Producers.That 56,000 estimate was from early November. What is it now?

When crude prices started collapsing late last year, Karr Ingham, a petroleum economist for the alliance, initially forecast that the state could lose 40,000 to 50,000 upstream oil and gas jobs during the downturn, but the fresh plunge in oil prices over the summer forced additional round of layoffs across Texas.

“We now appear to be well beyond that estimate and the end is not in sight,” Ingham said in a statement Thursday.

Unambiguously Good

The price of US and Brent crud both broke $28 to the downside today but remain hovering near that level.

Don't fret. I have it on good authority this decline in oil prices is "Unambiguously Good" for the economy.

In a CNBC video in November of 2014, Kudlow stated Drop in Oil Prices is Unambiguously Good.

It was not just Kudlow making such statements. Various Fed officials believed the same thing.

"We Got This Wrong"

Let's now flash forward to a bit of reality. On January 9, 2016, San Francisco Fed president John Williams finally admitted "We Got This Wrong".

Williams still does not realize precisely what is wrong.

Oil prices in and of themselves are inherently neither good nor bad. It all depends on why. In this case, the Fed sent false economic signals with round after round of QE, and by once again keeping interest rates too low, too long.

Effects were not seen in consumer prices as the Fed wanted. Rather, asset price bubbles developed in stocks, bonds, and junk bond borrowings of hundreds of billions of dollars to drill wells smack into a slumping global economy.

The only "tools" the Fed knows are rates cuts and QE. But that's what created this mess. And here we sit with the Fed still insisting four more hikes are coming in 2016.

The market now spits in the Fed's face.

Mike "Mish" Shedlock

Parade of Weakness: Housing Starts and Permits Slump in December

Housing starts, one of the presumed strengths in the economy, took a dive in December.

The Econoday Consensus Estimate was for 1.200 million starts vs. the actual report of 1.14 Million.

The above chart calls into question alleged strength from a historical basis. However, when calculating GDP, what matters is near-term comparisons (month-over-month and year-over-year).

Both of those can fluctuate strongly because of weather-related issues. Bloomberg smooths that out via a 5-month moving average.

Parade of Weakness

Have housing starts now stalled?

November might have one thinking "no", December might have one thinking "yes", and perhaps the 5-month average has one thinking "maybe".

Year-over-year comparisons in February and March will be very easy to beat. Starting in April, year-over-year comparisons will be difficult to beat for a long stretch. That's when apparent strength likely starts to look like apparent weakness.

Wasn't December supposed to be the warmest ever? Northern Illinois certainly was unusually mild. That should have added to December starts, but it didn't.

One typically only hears about the weather when makes matters worse. In this case, warm weather should have added to starts, but didn't.

Regardless of weather-related effects, home prices are no longer affordable. Millennials are priced out.

Manufacturing is in recession. Retail sales have stalled despite low gasoline prices. Autos sales were a disappointment. Inventory-to-sales numbers signal trouble, everywhere.

My bet is housing joins the parade of weakness.

Mike "Mish" Shedlock

The Econoday Consensus Estimate was for 1.200 million starts vs. the actual report of 1.14 Million.

Housing starts and permits both fell back in December but follow large gains in November. Starts came in at an annualized 1.149 million rate in December for a 2.5 percent monthly dip while permits came in at 1.232 million for a 3.9 percent decline. Yet both of these readings for November surged more than 10 percent. Year-on-year, starts are up a healthy 6.4 percent with permits especially strong at 14.4 percent.Respectable Strength Questioned

Starts for both single-family homes and multi-family homes fell in the month, down 3.3 percent to a 768,000 rate for the single-family category and down 1.0 percent to 381,000 for multi-family. Year-on-year, both are close at respective gains of 6.1 and 7.0 percent. The breakdown in permits shows a downdraft for multi-family homes, 11.4 percent lower to a 492,000 rate but which follows very strong gains in the prior two months. Permits for single-family homes rose 1.8 percent in the month to 740,000.

Housing completions jumped 5.6 percent in the month to edge over 1 million at 1.013 million, reflecting in part favorable weather. Homes under construction, also benefiting from the winter's mild weather, rose 1.7 percent with the year-on-year rate at plus 18.5 percent.

This report is below expectations and soft on a historical basis, but readings still point to respectable strength underway for new housing.

The above chart calls into question alleged strength from a historical basis. However, when calculating GDP, what matters is near-term comparisons (month-over-month and year-over-year).

Both of those can fluctuate strongly because of weather-related issues. Bloomberg smooths that out via a 5-month moving average.

Parade of Weakness

Have housing starts now stalled?

November might have one thinking "no", December might have one thinking "yes", and perhaps the 5-month average has one thinking "maybe".

Year-over-year comparisons in February and March will be very easy to beat. Starting in April, year-over-year comparisons will be difficult to beat for a long stretch. That's when apparent strength likely starts to look like apparent weakness.

Wasn't December supposed to be the warmest ever? Northern Illinois certainly was unusually mild. That should have added to December starts, but it didn't.

One typically only hears about the weather when makes matters worse. In this case, warm weather should have added to starts, but didn't.

Regardless of weather-related effects, home prices are no longer affordable. Millennials are priced out.

Manufacturing is in recession. Retail sales have stalled despite low gasoline prices. Autos sales were a disappointment. Inventory-to-sales numbers signal trouble, everywhere.

My bet is housing joins the parade of weakness.

Mike "Mish" Shedlock

الثلاثاء، 19 يناير 2016

Bernanke: Don't Worry, China's $28 Trillion Debt is an "Internal Problem"

$28 Trillion "Internal Problem"

The blue ribbon award for ridiculous comment of the day goes to Ben Bernanke who dismissed China's $28 trillion debt pile as an "internal problem" only.

This revelation came from the Asian Financial Forum held in Hong Kong where Bernanke Downplayed China Impact on World Economy.

Actually, I have to ask: Which is more ridiculous: Dismissing $28 trillion debt as an "internal problem" or proposing $28 trillion debt is indicative of a "savings glut"?

Mike "Mish" Shedlock

The blue ribbon award for ridiculous comment of the day goes to Ben Bernanke who dismissed China's $28 trillion debt pile as an "internal problem" only.

This revelation came from the Asian Financial Forum held in Hong Kong where Bernanke Downplayed China Impact on World Economy.

"I don't think China's economic slowdown is that severe to threaten the global economy," said Bernanke at the Asian Financial Forum held in Hong Kong.Savings Glut Question

Bernanke argued that the global economy was more troubled by a global savings glut, which had long been a drag on investments.

Bernanke also said the $28 trillion debt pile facing China was an "internal" problem, given the majority of the borrowings was issued in local currency. According to consultancy McKinsey & Co., government, corporate, and household debt in China had already hit 282% of the country's gross domestic product as of mid-2014.

Bernanke said the correlation between different markets is higher than that between markets and the economy. He pointed out that worldwide market selloffs in times of distress was natural due to global asset allocations. "The U.S. and China are not as closely tied as the market thinks," Bernanke said.

Contrary to Bernanke's views on the global impact of a Chinese slowdown, the IMF said in its latest World Economic Outlook Update released on Tuesday that "a sharper-than expected slowdown in China" was a significant risk that would bring "international spillovers through trade, commodity prices, and waning confidence."

Actually, I have to ask: Which is more ridiculous: Dismissing $28 trillion debt as an "internal problem" or proposing $28 trillion debt is indicative of a "savings glut"?

Mike "Mish" Shedlock

Mexico Central Bank Warns of "Potentially Severe Shock" Caused by Credit Crunch, Seeks Emerging Market "Buyer of Last Resort"

Fears of Emerging Market Credit Crunch

The growing likelihood of an emerging market crunch is on the mind of Agustín Carstens, head of Mexico's central bank.

Carstens now warns of a "Potentially Severe Shock".

Operation Twist

In essence, Carstens is discussing something like "Operation Twist" in which the Fed sold short-term Treasury notes and bought long-term Treasury bonds. Supposedly, the move pressured the long-term bond yields downward.

The Fed conducted an "Operation Twist" in the 60's and again in 2011. A recent federal reserve bank study shows the move many have lowered long-term rates by a mere fifteen basis points (0.15 percentage points).

How that would help emerging markets is a mystery. And if the assets in question are not government securities, the central banks could conceivably be left holding bags that are worthless.

Intervention Causes Problems

By attempting to smooth over every recession, every bank failure, and every market hiccup, central banks have created a global economic mess.

The global economy does not need a buyer of last resort other than the free market. If prices get cheap enough, someone will buy.

China's ill-advised stock market intervention recently blew up in China's face. Switzerland's seriously misguided peg to the Euro unleashed massive volatility wiping out every foreigner foolish enough to take out loans in Swiss Francs, expecting the peg to hold.

The Fed itself has created three bubbles of increasing amplitude: Dotcom bubble, the housing bubble, and the current equity and junk bond bubbles.

Suppression of volatility does nothing but create a series of unstable pressure cookers. The lids eventually blow off the top.

Mike "Mish" Shedlock

The growing likelihood of an emerging market crunch is on the mind of Agustín Carstens, head of Mexico's central bank.

Carstens now warns of a "Potentially Severe Shock".

Central banks in emerging markets could follow counterparts in the developed world and become “market makers of last resort”, using unconventional monetary policies to try and stimulate their flatlining economies, according to Mexico’s central bank chief.

“Emerging markets need to be ready for a potentially severe shock,” Mr Carstens told the Financial Times. “The adjustment could be violent and policymakers need to be ready for it.”

Policymakers and economists have warned that heavy selling of EM stocks and bonds by international investors since the middle of last year threatens to provoke a credit crunch that would make it hard for EM companies to service their debts.

Many EM companies have filled up on cheap credit over the past decade, after a commodities boom and ultra-loose monetary policies led by the US Federal Reserve resulted in very low borrowing costs. As investors pull out, those costs are set to soar.

Mr Carstens said the required policy response from EM central bankers would stop short of outright “quantitative easing” or QE — the large-scale buying of financial assets undertaken by the Fed and other developed market central banks.

But it would include exchanging high risk, long-dated assets held by investors for less risky, shorter-dated central bank and government liabilities.

Operation Twist

In essence, Carstens is discussing something like "Operation Twist" in which the Fed sold short-term Treasury notes and bought long-term Treasury bonds. Supposedly, the move pressured the long-term bond yields downward.

The Fed conducted an "Operation Twist" in the 60's and again in 2011. A recent federal reserve bank study shows the move many have lowered long-term rates by a mere fifteen basis points (0.15 percentage points).

How that would help emerging markets is a mystery. And if the assets in question are not government securities, the central banks could conceivably be left holding bags that are worthless.

Intervention Causes Problems

By attempting to smooth over every recession, every bank failure, and every market hiccup, central banks have created a global economic mess.

The global economy does not need a buyer of last resort other than the free market. If prices get cheap enough, someone will buy.

China's ill-advised stock market intervention recently blew up in China's face. Switzerland's seriously misguided peg to the Euro unleashed massive volatility wiping out every foreigner foolish enough to take out loans in Swiss Francs, expecting the peg to hold.

The Fed itself has created three bubbles of increasing amplitude: Dotcom bubble, the housing bubble, and the current equity and junk bond bubbles.

Suppression of volatility does nothing but create a series of unstable pressure cookers. The lids eventually blow off the top.

Mike "Mish" Shedlock

Sudden Belief in Abenomics; Bets on Yen Hit Three-Year High; Yen a "Safe Haven"?

Sudden Belief in Abenomics

Traders are increasingly betting that Japanese prime minister Shinzō Abe will not follow through on his plans to do whatever it takes to defeat deflation in Japan (or that he has already done enough and won't do any more).

Bets on Yen Hit Three-Year High

Currency futures show Bets on Yen Strength Climb to Three-Year High.

Switch in Sentiment

At the start of 2012 the Yen traded at 76.23 to the dollar. It's now at 117.48 to the dollar. That's a decline of 35%.

In May, the Yen hit a low of 125.86 to the dollar. Since then, sentiment on the Yen switched wildly as shown by currency bets.

Here's why.

Japanese GDP Revised to Growth

On December 8, the Financial Times reported Japan GDP Revised From Recession to Growth in Q3.

Is the Yen now a safe haven?

Apparently traders think so. I don't. Japan will not decouple from the global economy.

And on the next downturn in Japan, Abe is likely to try anything. In the meantime, as long as Abe does not see need for further stimulus, the Yen may have further to run.

With all the currency traders suddenly believing in Abenomics, a swing back to the other side could produce significant currency moves the other way.

Mike "Mish" Shedlock

Traders are increasingly betting that Japanese prime minister Shinzō Abe will not follow through on his plans to do whatever it takes to defeat deflation in Japan (or that he has already done enough and won't do any more).

Bets on Yen Hit Three-Year High

Currency futures show Bets on Yen Strength Climb to Three-Year High.

US Dollar / Yen Monthly

Bets the yen will strengthen climbed to the highest level in three years as concern global growth is slowing spurred demand for the relative safety of Japan’s currency.

Hedge funds and other large speculators boosted net long positions on the yen to 25,266 contracts in the week through Jan. 12, the most since October 2012, based on futures. Japan’s currency rose to the strongest since August versus the dollar last week as a slump in stocks around the world and signs China’s economy is losing momentum pushed back expectations for the Federal Reserve’s next interest-rate increase.

“I can’t see the exit from this tendency toward risk aversion,” Toshiya Yamauchi, a senior analyst in Tokyo at Ueda Harlow Ltd., a margin-trading services provider, wrote in a note to clients. “The drop in stocks and yen currency crosses will continue to weigh on dollar-yen.”

Switch in Sentiment

At the start of 2012 the Yen traded at 76.23 to the dollar. It's now at 117.48 to the dollar. That's a decline of 35%.

In May, the Yen hit a low of 125.86 to the dollar. Since then, sentiment on the Yen switched wildly as shown by currency bets.

Here's why.

Japanese GDP Revised to Growth

On December 8, the Financial Times reported Japan GDP Revised From Recession to Growth in Q3.

Growth for the third quarter was revised on Tuesday from an annualised fall of 0.8 per cent to an annualised rise of 1 per cent, erasing the technical “recession” declared just three weeks ago.Yen a "Safe Haven"?

Investment was the main force behind the revisions: it was amended from a quarter on quarter fall of 1.3 per cent to a rise of 0.6 per cent. Instead of subtracting 0.7 percentage points from annualised growth, therefore, it added 0.3 percentage points.

“As a result of annual revision to the past data, the entire trajectory of inventory investment since 2013 was revised up significantly,” said Ryutaro Kono at BNP Paribas in Tokyo. “This is not great news for growth in coming quarters.”

Is the Yen now a safe haven?

Apparently traders think so. I don't. Japan will not decouple from the global economy.

And on the next downturn in Japan, Abe is likely to try anything. In the meantime, as long as Abe does not see need for further stimulus, the Yen may have further to run.

With all the currency traders suddenly believing in Abenomics, a swing back to the other side could produce significant currency moves the other way.

Mike "Mish" Shedlock

Italian Banks Hammered; Bad Loans Hit €201 Billion; End of Draghi PUT; Get Out Now!

Italian Banks Hammered

Things don't matter until they do. For whatever reason, things in Europe are starting to matter. For example, Bloomberg reports Italian Banks Lead European Decliners on Bad-Loan Concerns.

Via translation from El Economista here are a few snips on Italian bank woes.

Bloomberg reports European Bank Stocks Rewind to 2012 as Draghi Rally Wanes.

I repeat my call for depositors in Italian banks, just as I did numerous times before Greece restricted bank withdrawals: "Get out now!"

Mike "Mish" Shedlock

Things don't matter until they do. For whatever reason, things in Europe are starting to matter. For example, Bloomberg reports Italian Banks Lead European Decliners on Bad-Loan Concerns.

Italian banks dropped in Milan, leading declines in the European Stoxx 600 Banks Index, reflecting investor concerns about lenders’ levels of bad debt as the European Central Bank seeks to toughen scrutiny of the region’s non-performing loans.Not Enough Money to Make a Bad Bank

Banca Monte dei Paschi di Siena SpA, bailed out twice since 2009, slumped 15 percent to 76.6 cents in Milan, a fresh record low. Unione di Banche Italiane SpA fell 7.3 percent, while Banco Popolare SC declined 6.7 percent. Europe’s 46-member Stoxx 600 Banks Index decreased 1.9 percent to the lowest since November 2012, bringing losses this year to 15 percent.

Italian banks’ bad loans reached a record high of 201 billion euros ($219 billion) in November, with record-low interest rates and a struggling economy squeezing profit margins. The ECB’s Single Supervisory Mechanism is seeking additional information about lenders’ non-performing loans in order to tackle bad debt across the region, a spokesman said, confirming a Sunday report by Reuters.

“A task force on non-performing loans is reviewing the situation of institutions with high levels of NPLs and will propose follow-up actions,” the central bank said.

In Italy, the government has been struggling to win approval for a bad bank to help speed up disposals of soured loans. Tensions between the country and the European Commission mounted earlier this month when Juncker publicly questioned Renzi’s criticism over an alleged lack of flexibility.

Italian market regulator Consob imposed a ban on short selling of Monte dei Paschi’s stock for the remainder of Monday’s session through Jan. 19, in an attempt to stabilize shares of the world’s oldest bank, which have dropped about 34 percent this year.

Subordinated and senior bonds in troubled banks including Monte dei Paschi, Banca Popolare di Vicenza and Veneto Banca have slumped to record lows this month. Monte Paschi’s 379 million euros of 5.6 percent junior notes fell more than 10 cents to 71.7 cents on Monday, surpassing the previous record low of November 2011.

Via translation from El Economista here are a few snips on Italian bank woes.

Construction of a bad bank has been a constant headache for the Italian authorities. Minister of Economy, Pier Carlo Padoan, acknowledged that the government's intention is to create a bad bank for toxic assets, but coffers of the country do not have enough money to engender this entity.End of the Draghi PUT?

Giuseppe Castagna, CEO of Banca Popolare di Milano, acknowledged in June that "there is not enough money to make a bad bank in Italy."

Now, the choice is private investors, something that seems unlikely considering that the carrying amount granted by the Italian authorities to these dubious assets is too high.

Bloomberg reports European Bank Stocks Rewind to 2012 as Draghi Rally Wanes.

The bank-stock rally sparked in 2012 by Mario Draghi’s pledge to save the euro is fizzling.Get Out Now!

Lenders in the benchmark Stoxx Europe 600 Index have erased about a third of their value since reaching a four-year high in July, falling to their lowest levels since November 2012. The European Central Bank president’s vow that year to do whatever it takes to avert a breakup of the region stoked investor optimism and helped bank shares almost double in the three years that followed.

I repeat my call for depositors in Italian banks, just as I did numerous times before Greece restricted bank withdrawals: "Get out now!"

Mike "Mish" Shedlock

الاثنين، 18 يناير 2016

Not Satisfied: First Time Ever, Majority in U.S. Now Dissatisfied With Security From Terrorism

Here's a Gallup Poll headline that plays straight into Donald Trump's hands: Majority in U.S. Now Dissatisfied With Security From Terrorism.

Trends in Satisfaction

I have played this before but it's an all-time classic hit.

I can't get no satisfaction. Can you?

Mike "Mish" Shedlock

Trends in Satisfaction

- 2012: 72% Satisfied

- 2013: 67% Satisfied

- 2014: 69% Satisfied

- 2015: 59% Satisfied

- 2016: 43% Satisfied

I have played this before but it's an all-time classic hit.

I can't get no satisfaction. Can you?

Mike "Mish" Shedlock

Full of Bull: Wall Street Analysts' S&P 500 Predicted Gains vs. Actual Gains 2001-2015

Analyzing the Forecasters

How overoptimistic are Wall Street forecasts year in and year out?

Salil Mehta, business statistics professor at Georgetown University addresses that question on his "Statistical Ideas" blog: Strategists Full of Bull.

Mehta collected 186 public forecasts from 1998-2015 of the annual ritual of making market projections for the year ahead.

Firms included JPMorgan, Citigroup, Goldman Sachs, Merrill Lynch, Bear Stearns, Lehman, Morgan Stanley, Prudential, UBS, AG Edwards, Bank of America, etc. Not every company made a forecast every year. Some of the firms are now extinct.

Data primarily comes from Barron’s as far back in time as continuously available. For a couple years, when Barron’s data wasn’t easily available, Mehta used market prediction made in USA Today’s or similar surveys.

Forecasters Full of Bull

Results were no better than a coin toss as to whether the S&P came in above or below the average forecast.

Nonetheless, every year had one thing in common: Not once did a consensus predict a down year.

On average, forecasts were wildly bullish, even with the gains in recent years.

In his analysis, Mehta focused primarily on distribution and standard deviations. Some may find his dispersion charts confusing. To his credit, Mehta made his Analyst Forecast Data available for others to analyze and I took him up on it.

Data prior to 2001 was for the Dow. I used years 2001-2015 in my analysis so the numbers are consistent line to line.

In the table below, S&P 500 projections are the average of all the analysts making calls for that year.

S&P 500 Predicted Gains vs. Actual Gains

15-Year Results

2016 Projections

2016 Analysis

For 2016, five out of ten companies predicted the S&P would end the year at 2200. Is that the magic number?

Goldman Sachs dared to be significantly different on the low side with a +2.74% forecast. Federated Investors projects a whopping +22.31% gain.

As typical, no company forecasts a decline.

Results year-to-date through January 17: -8.02%.

Don't worry, it's early.

Mike "Mish" Shedlock

How overoptimistic are Wall Street forecasts year in and year out?

Salil Mehta, business statistics professor at Georgetown University addresses that question on his "Statistical Ideas" blog: Strategists Full of Bull.

Mehta collected 186 public forecasts from 1998-2015 of the annual ritual of making market projections for the year ahead.

Firms included JPMorgan, Citigroup, Goldman Sachs, Merrill Lynch, Bear Stearns, Lehman, Morgan Stanley, Prudential, UBS, AG Edwards, Bank of America, etc. Not every company made a forecast every year. Some of the firms are now extinct.

Data primarily comes from Barron’s as far back in time as continuously available. For a couple years, when Barron’s data wasn’t easily available, Mehta used market prediction made in USA Today’s or similar surveys.

Forecasters Full of Bull

Results were no better than a coin toss as to whether the S&P came in above or below the average forecast.

Nonetheless, every year had one thing in common: Not once did a consensus predict a down year.

On average, forecasts were wildly bullish, even with the gains in recent years.

In his analysis, Mehta focused primarily on distribution and standard deviations. Some may find his dispersion charts confusing. To his credit, Mehta made his Analyst Forecast Data available for others to analyze and I took him up on it.

Data prior to 2001 was for the Dow. I used years 2001-2015 in my analysis so the numbers are consistent line to line.

In the table below, S&P 500 projections are the average of all the analysts making calls for that year.

S&P 500 Predicted Gains vs. Actual Gains

| Date | Predicted S&P | Predicted Gain% | Actual S&P | Actual Gain% | Gain Difference |

|---|---|---|---|---|---|

| 2001 | 1697 | 28.56% | 1148 | -13.03% | -41.59% |

| 2002 | 1278 | 11.28% | 880 | -23.34% | -34.63% |

| 2003 | 1019 | 15.81% | 1112 | 26.36% | 10.56% |

| 2004 | 1133 | 1.92% | 1212 | 8.99% | 7.07% |

| 2005 | 1257 | 3.69% | 1248 | 2.97% | -0.72% |

| 2006 | 1372 | 9.93% | 1418 | 13.62% | 3.70% |

| 2007 | 1519 | 7.11% | 1468 | 3.53% | -3.59% |

| 2008 | 1640 | 11.75% | 903 | -38.49% | -50.23% |

| 2009 | 1045 | 15.77% | 1115 | 23.48% | 7.71% |

| 2010 | 1239 | 11.09% | 1258 | 12.83% | 1.73% |

| 2011 | 1373 | 9.16% | 1258 | 0.00% | -9.16% |

| 2012 | 1355 | 7.73% | 1426 | 13.35% | 5.63% |

| 2013 | 1562 | 9.57% | 1848 | 29.59% | 20.03% |

| 2014 | 1977 | 7.00% | 2059 | 11.42% | 4.42% |

| 2015 | 2209 | 7.26% | 2044 | -0.73% | -7.99% |

| 2016 | 2220 | 8.61% |

15-Year Results

- Actual gains were negative 4 times, zero 1 time, positive 10 times.

- Analysts overestimated the actual result 7 times and underestimated results 8 times. That's a coin toss. What follows shows distinct bullish bias.

- Analysts projected gains 100% of the time.

- Spectacular misses (30% or more) were all in down years.

- The average year-to-year projected gain over 15 years was 9.85%.

- The average actual gain over 15 years was 4.75% (slightly less than half projection).

2016 Projections

| Company | S&P 500 Projection | Projected % Gain |

|---|---|---|

| Federated Investors | 2500 | 22.31% |

| JPMorgan | 2200 | 7.63% |

| Barclays | 2200 | 7.63% |

| Citi | 2200 | 7.63% |

| Columbia | 2200 | 7.63% |

| Morgan Stanley | 2175 | 6.41% |

| Black Rock | 2175 | 6.41% |

| Prudential | 2250 | 10.08% |

| Goldman Sachs | 2100 | 2.74% |

| Bank of America ML | 2200 | 7.63% |

2016 Analysis

For 2016, five out of ten companies predicted the S&P would end the year at 2200. Is that the magic number?

Goldman Sachs dared to be significantly different on the low side with a +2.74% forecast. Federated Investors projects a whopping +22.31% gain.

As typical, no company forecasts a decline.

Results year-to-date through January 17: -8.02%.

Don't worry, it's early.

Mike "Mish" Shedlock

Hollande Declares "Economic Emergency" to Save Jobs - His; Mish Proposal to Create French Jobs

Emergency Effort to Save Hollande's Job

With a national election 15 months away and unemployment not falling, a crisis in France emerged: French president Francois Hollande's own job is at risk.

Having promised to step down as president if unemployment in France fails to drop this year, Hollande took the necessary action.

He declared a state of emergency to save jobs, namely his.

Hollande Declares State of Emergency

Please consider Hollande Outlines Jobs Plan to Tackle Economic 'Emergency'

Nicolas Lecaussin, head of Institute for Research in Economic and Fiscal Issues, a liberal think-tank, described the new measures as “old recipes”. Mr Lecaussin added: “Training schemes are controlled by unions and efforts to boost apprenticeships have failed repeatedly over the years. As always when presidential elections loom, we’re entering a phase of public spending increases.”

How to Create Jobs

The primary reason French companies will not hire workers is that it's so damn hard to get rid of them later if they do.

Add to that mountains of regulations including inane laws that tell businesses when they can or cannot open the doors.

If Hollande wants to create jobs, this is what he needs to do.

Points number one and two would be a good start. But even if Hollande stopped with those two points, the socialists would fire him.

Hollande's proposals prove he is not really interested in doing what it takes to create jobs. Rather, he only wants to do what is necessary to save his.

Mike "Mish" Shedlock

With a national election 15 months away and unemployment not falling, a crisis in France emerged: French president Francois Hollande's own job is at risk.

Having promised to step down as president if unemployment in France fails to drop this year, Hollande took the necessary action.

He declared a state of emergency to save jobs, namely his.

Hollande Declares State of Emergency

Please consider Hollande Outlines Jobs Plan to Tackle Economic 'Emergency'

François Hollande has returned to traditional leftwing tenets for a last-ditch plan to cut persistently high unemployment and salvage his chances of re-election next year, saying France is in an economic “state of emergency”.Training Schemes

The measures, which the president detailed in a speech on Monday, involve the creation of 500,000 vocational training schemes, additional subsidies for small companies and a programme to boost apprenticeships.

“We have to act so that growth becomes more robust and job creation more abundant,” Mr Hollande said in an address to unions and business leaders.

Since 2012, when Mr Hollande came to power, more than 600,000 people have joined the ranks of the unemployed at a time when joblessness has decreased in most of the other large European economies. Despite recovering margins, companies are still hesitant to hire workers.

Under Monday’s announcement, which takes effect immediately, companies with fewer than 250 workers will receive a €2,000 payout for hiring youths and unemployed people on low salaries for contracts lasting more than six months. Temporary tax breaks, announced in 2014, will become permanent, Mr Hollande said.

A package of liberalising reforms passed in parliament last year, spearheaded by Emmanuel Macron, the reformist economy minister, has not spurred employment significantly. Doubts are mounting over Mr Macron’s ability to push through additional reforms this year.

Nicolas Lecaussin, head of Institute for Research in Economic and Fiscal Issues, a liberal think-tank, described the new measures as “old recipes”. Mr Lecaussin added: “Training schemes are controlled by unions and efforts to boost apprenticeships have failed repeatedly over the years. As always when presidential elections loom, we’re entering a phase of public spending increases.”

How to Create Jobs

The primary reason French companies will not hire workers is that it's so damn hard to get rid of them later if they do.

Add to that mountains of regulations including inane laws that tell businesses when they can or cannot open the doors.

If Hollande wants to create jobs, this is what he needs to do.

- Make it easier for businesses to fire workers.

- Let any business that wants to do so, open the doors on Sunday.

- Reduce unemployment benefits.

- Get rid of countless regulations telling businesses what they can and cannot do.

- Get rid of tariffs and subsidies.

- Cut taxes, both corporate and personal. Become a pro-business country.

Points number one and two would be a good start. But even if Hollande stopped with those two points, the socialists would fire him.

Hollande's proposals prove he is not really interested in doing what it takes to create jobs. Rather, he only wants to do what is necessary to save his.

Mike "Mish" Shedlock

Rumors on Mark-to-Market Accounting and Loan Loss Provisions: What's the Real Story?

Energy-Related Losses Mount

Bank loan loss impairments related to the energy sector are set to rise rapidly.

Banks have made drilling loans to companies that are only profitable at oil prices above $50. And the price of oil just closed under $30 for the first time in about 12 years.

Diving Into Rumors

Zero Hedge has an interesting post on Saturday entitled Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears.

In his post, ZeroHedge claims "The Dallas Fed met with the banks a week ago and effectively suspended mark-to-market on energy debts and as a result no impairments are being written down. Furthermore, as we reported earlier this week, the Fed indicated 'under the table' that banks were to work with the energy companies on delivering without a markdown on worry that a backstop, or bail-in, was needed after reviewing loan losses which would exceed the current tier 1 capital tranches."

Mark-to-Market Accounting History

You cannot suspend what has already been suspended.

On April 3, 2009, the Wall Street Journal reported FASB Eases Mark-to-Market Rules.

Suspension of mark-to-market account was one of the factors that ignited the stock market in Spring of 2009.

Wikipedia has these notes on Mark-to-Market Accounting.

No Subsequent Mark-to-Market Changes

There have been no subsequent changes. And here we are, back in bubble land, with hidden losses mounting again.

By, how much? Who the hell knows because mark-to-market accounting has already been effectively suspended.

We do have some facts, however.

More Banks Take Energy Hits

The Wall Street Journal reports More Banks Take Hits on Energy Loans.

On January 14, The Wall Street Journal asked: Turning Point? J.P. Morgan Builds Loss Reserves for the First Time in Six Years

ZeroHedge's initial rumor the "Dallas Fed members had met with banks in Houston and explicitly told them not to force energy bankruptcies and to demand asset sales instead." could very well be true.

There's not much shocking in that statement actually.

ZeroHedge concluded "The Dallas Fed, whose new president Robert Steven Kaplan previously worked at Goldman Sachs for 22 years rising to the rank of vice chairman of investment banking, has not responded to our request for a comment as of this writing."

Regardless of what Kaplan instructed the banks to do, bankruptcies cannot be avoided by selling assets.

Sell what assets? At what price?

The assets in question are rigs, land, and drilling rights. What demand is there for used rigs? And what near-term value do energy properties have at current energy prices?

Oil reserves and the value of those reserves have both collapsed.

Bankruptcies are coming and with them so will loan losses. Either loan loss provisions rise now, or bankruptcies impose unannounced losses in the not so distant future.

Wells Fargo Is Bad, But Citi Is Worse

In an update on Sunday, ZeroHedge posted Wells Fargo Is Bad, But Citi Is Worse.

Citi refused to provide its loan loss provisions on energy. But it did provide exposure information. Funded exposure is $20.5 billion. 68% of that is investment grade. That makes $6.56 billion junk.

I am not here to defend Citi. I am here to inject a bit of realism.

Losses related to energy, whatever they may be, will be much smaller than losses related to the housing bubble crash.

Let's explore that idea with a series of charts.

Loan Loss Reserves to Total Loans

Loan loss provisions kept rising in spite of mark-to-market suspension. The market imposed losses, but admission was at a "pace that was measured".

Loan loss reserves as a percentage of total loans hit a record high 3.70% in first quarter of 2010. Loan losses for the Dallas region peaked in third quarter of 2011 at 2.11%.

Let's now investigate loan loss allowances in dollar amounts, starting with the Dallas region.

Allowance for Loans and Lease Losses, Dallas

The allowance for loans an lease losses in the Dallas region peaked at $4.412 billion in the third quarter of 2010. It is currently at $3.08 billion.

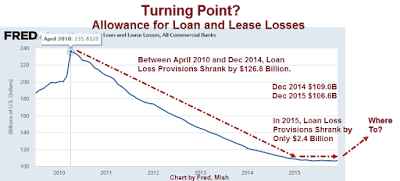

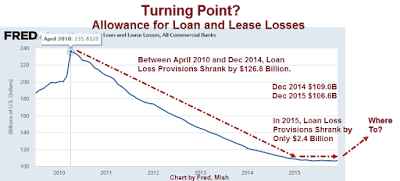

Allowance for Loans and Lease Losses, All Commercial Banks

The allowance for loans and lease losses for all commercial banks peaked in April 2010 at $235.8 billion vs. $4.4 billion for the Dallas region alone.

Even if fears over energy-related oil losses are a bit overblown, problems are beginning to mount and it's highly likely to spill over into many other sectors of the economy.

The consumer is not doing all that well. Home prices are once again well beyond affordable. Manufacturing is in an outright recession. The rest of the economy is poised to follow manufacturing, or already has.

Turning Point

Declining loan loss provisions are net accruals to earning. Rising loan loss provisions are subtractions from earnings.

Between April 2010 and December 2014 loan loss provisions shrank by $126.8 billion, directly padding bank bottom lines.

In 2015, the decline in loan loss provisions was a mere $2.4 billion.

The real story is not the alleged suspension of mark-to-market rules. Rather, the real story is rising loan and lease loss provisions, across numerous segments, not just energy.

I expect loan loss provisions for housing, construction loans, subprime autos, credit cards, malls, and of course energy, will all rise.

This is a significant turning point. Loan and lease losses have only one way to go: Up. How high remains to be seen, but the effect on earnings won't be pretty.

To top it off, Iran About to Unleash Tidal Wave of Oil Into Depressed Markets.

Mike "Mish" Shedlock

Bank loan loss impairments related to the energy sector are set to rise rapidly.

Banks have made drilling loans to companies that are only profitable at oil prices above $50. And the price of oil just closed under $30 for the first time in about 12 years.

Diving Into Rumors

Zero Hedge has an interesting post on Saturday entitled Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears.

In his post, ZeroHedge claims "The Dallas Fed met with the banks a week ago and effectively suspended mark-to-market on energy debts and as a result no impairments are being written down. Furthermore, as we reported earlier this week, the Fed indicated 'under the table' that banks were to work with the energy companies on delivering without a markdown on worry that a backstop, or bail-in, was needed after reviewing loan losses which would exceed the current tier 1 capital tranches."

Mark-to-Market Accounting History

You cannot suspend what has already been suspended.

On April 3, 2009, the Wall Street Journal reported FASB Eases Mark-to-Market Rules.

Suspension of mark-to-market account was one of the factors that ignited the stock market in Spring of 2009.

Wikipedia has these notes on Mark-to-Market Accounting.

- On September 30, 2008, the SEC and the FASB issued a joint clarification regarding the implementation of fair value accounting in cases where a market is disorderly or inactive. Section 132 of the Emergency Economic Stabilization Act of 2008, which passed on October 3, 2008, restated the SEC's authority to suspend the application of FAS 157.

- On October 10, 2008, the FASB issued further guidance to provide an example of how to estimate fair value in cases where the market for that asset is not active at a reporting date.

- On December 30, 2008, the SEC issued its report under Sec. 133 and decided not to suspend mark-to-market accounting. [Mish Comment: Markets that rallied into the end of the year, collapsed again in January and February]

- On March 16, 2009, FASB proposed allowing companies to use more leeway in valuing their assets under "mark-to-market" accounting. On April 2, 2009, after a 15-day public comment period and a contentious testimony before the U.S. House Financial Services subcommittee, FASB eased the mark-to-market rules through the release of three FASB Staff Positions (FSPs). Financial institutions are still required by the rules to mark transactions to market prices but more so in a steady market and less so when the market is inactive. To proponents of the rules, this eliminates the unnecessary "positive feedback loop" that can result in a weakened economy. [Mish Comment: Markets took off just ahead of the change and never looked back]

- On April 9, 2009, FASB issued an official update to FAS 157 that eases the mark-to-market rules when the market is unsteady or inactive. Early adopters were allowed to apply the ruling as of March 15, 2009, and the rest as of June 15, 2009. It was anticipated that these changes could significantly increase banks' statements of earnings and allow them to defer reporting losses.

No Subsequent Mark-to-Market Changes

There have been no subsequent changes. And here we are, back in bubble land, with hidden losses mounting again.

By, how much? Who the hell knows because mark-to-market accounting has already been effectively suspended.

We do have some facts, however.

More Banks Take Energy Hits

The Wall Street Journal reports More Banks Take Hits on Energy Loans.

Months of low oil prices are starting to take a toll on banks. Large U.S. banks reporting earnings Friday said they saw more energy loans go bad in the fourth quarter. Many lenders also added millions of dollars to reserves in anticipation that more oil-and-gas loans will sour.J.P. Morgan Builds Loss Reserves for the First Time in Six Years

“It’s starting to spread,” said William Demchak, chief executive of PNC Financial Services Group Inc. on a conference call after the bank’s earnings were announced. Credit issues from low energy prices are affecting “anybody who was in the game as the oil boom started,” he said.

Citigroup Inc. added to its rainy-day reserves for soured loans for the first time since 2009, adding $250 million specifically for energy and $494 million overall. “Obviously there is some pressure in the energy-related markets at this point in time,” John Gerspach, Citigroup’s chief financial officer, said on a conference call Friday.

As many as one-third of American oil-and-gas producers could tip toward bankruptcy and restructuring by mid-2017, according to Wolfe Research. Survival, for some, would be possible if oil rebounded to at least $50 a barrel, many analysts say.

Concerns about oil and gas exposure have battered the stocks of banks with big energy portfolios. Zions Bancorp shares are down 18% since the beginning of the year, while BOK’s are down 20% and Cullen/Frost Bankers Inc. shares are down 22% during that period. The KBW Nasdaq Bank Index is down 13% amid a broad market decline.

Still, banks continue to maintain that any energy losses remain manageable.

Wells Fargo & Co. had $90 million in higher losses in its oil-and-gas portfolio during the fourth quarter, and the bank said it boosted its commercial-loan reserves as a result. Wells Fargo played down the potential impact of the energy problems, noting that oil and gas loans remained around only 2% of its total loans, and that more than 90% of the problem oil-and-gas loans in its portfolio were current on their interest payments as of the end of 2015.

On January 14, The Wall Street Journal asked: Turning Point? J.P. Morgan Builds Loss Reserves for the First Time in Six Years

J.P. Morgan Chase & Co. built up its reserves for bad loans, a shift that spotlights Wall Street’s mounting concerns about the fate of oil and gas companies.Bankruptcies Coming Regardless

J.P. Morgan added $136 million to its loan-loss reserves in the fourth quarter of 2015, according to the bank, or $187 million if provisions for lending-related commitments are included.

The New York bank, the largest in the country by assets, said the bulk of its added reserves, $124 million, were related to its portfolio of loans to oil and gas companies.

But the bank doesn’t expect to drastically reduce its energy lending, Chief Executive James Dimon said on a call with analysts. “If banks just completely pull out of markets every time something gets volatile or scary, you’ll be sinking companies left and right.”

Citigroup Inc. said in December it was likely to add $300 million to $400 million to its reserves, primarily because of low oil prices. Citigroup and Wells Fargo & Co. announce their fourth-quarter earnings Friday, with Bank of America Corp. to follow on Tuesday. Spokesmen for Citigroup and BofA declined to comment. A Wells Fargo spokesman couldn’t immediately be reached.

J.P. Morgan’s move on Thursday was the first time any of the big four U.S. banks has added to its loan-loss reserves since the fourth quarter of 2009.

The buildup was also notable as it indicates the potential end of an era in which “releases” of loan-loss reserves flowed into and offered a welcome boost to banks’ earnings, at a time when the banks often had difficulty generating profits from their operating businesses. Over the past six years, those releases have contributed nearly $25 billion to J.P. Morgan’s pretax income, and about $86 billion to the four banks’ total pretax income.

“You can’t release loan-loss reserves forever,” said Jason Goldberg, an analyst at Barclays PLC. “We’re actually surprised reserve levels got this low.”

ZeroHedge's initial rumor the "Dallas Fed members had met with banks in Houston and explicitly told them not to force energy bankruptcies and to demand asset sales instead." could very well be true.

There's not much shocking in that statement actually.

ZeroHedge concluded "The Dallas Fed, whose new president Robert Steven Kaplan previously worked at Goldman Sachs for 22 years rising to the rank of vice chairman of investment banking, has not responded to our request for a comment as of this writing."

Regardless of what Kaplan instructed the banks to do, bankruptcies cannot be avoided by selling assets.

Sell what assets? At what price?

The assets in question are rigs, land, and drilling rights. What demand is there for used rigs? And what near-term value do energy properties have at current energy prices?

Oil reserves and the value of those reserves have both collapsed.

Bankruptcies are coming and with them so will loan losses. Either loan loss provisions rise now, or bankruptcies impose unannounced losses in the not so distant future.

Wells Fargo Is Bad, But Citi Is Worse

In an update on Sunday, ZeroHedge posted Wells Fargo Is Bad, But Citi Is Worse.

Earlier we reported that Wells Fargo may have an energy problem because as CFO John Shrewsbury revealed, of the $17 billion in energy exposure, "most of it" was junk rated.Citi Math and a Bit of Realism

But, while one can speculate what the terminal cumulative losses, cumulative defaults and loss severities on this loan book will be, at least Wells was honest enough to reveal its energy-related loan loss estimate: it was $1.2 billion, or 7% of total - as Mike Mayo pointed out, one of the highest on the street. Whether it is high, or low, is anyone's guess, but at least Wells disclosed it.

Citi did not.

Note the following perplexing exchange between analyst Mike Mayo and Citi CFO John Gerspach:

Mike Mayo: Can we move to energy, though? I don't want you being the only bank not disclosing reserves to energy - oil and gas loans. I mean, I think most others have disclosed that who have reported so far. And I mean, your stock's down 7%. The whole market is down a whole lot, but I don't - even if it's a low number, it can't hurt too much more from here. And so can you - how much in oil and gas loans do you have, and what are the reserves taken against that? I know you were asked this already, but I'm going back for a second try.

John Gerspach: When you take a look at the overall portfolio, Mike, we've reduced the amount of exposure. Our funded exposure to energy-related companies this quarter is down 4%. It's about $20.5 billion. The overall exposure also came down about 4%. The overall exposure now is about $58 billion, that includes unfunded. When you take a look at the composition of the funded portfolio, about 68% of that portfolio would be investment grade. That's up from the 65% that we would have had at the end of the third quarter. And the unfunded book is about 87% investment grade. So while we are taking what we believe to be the appropriate reserves for that, I'm just not prepared to give you a specific number right now as far as the amount of reserves that we have on that particular book of business. That's just not something that we've traditionally done in the past.

One wonders just how much of Gerspach's decision was dictated by the Fed's under the table suggestion to avoid mark to market in energy entirely, and thus to stop marking its loan book.

Finally, we eagerly await for someone from the Dallas Fed to contact us and to comment on our article from yesterday that the "Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears." Because with megabanks such as Citi refusing to disclose energy losses, the longer the Fed remains mute on just what it knows that nobody else does, the more concerned the market will be that the subprime crisis is quietly playing out under its nose all over again.

Citi refused to provide its loan loss provisions on energy. But it did provide exposure information. Funded exposure is $20.5 billion. 68% of that is investment grade. That makes $6.56 billion junk.

I am not here to defend Citi. I am here to inject a bit of realism.

Losses related to energy, whatever they may be, will be much smaller than losses related to the housing bubble crash.

Let's explore that idea with a series of charts.

Loan Loss Reserves to Total Loans

Loan loss provisions kept rising in spite of mark-to-market suspension. The market imposed losses, but admission was at a "pace that was measured".

Loan loss reserves as a percentage of total loans hit a record high 3.70% in first quarter of 2010. Loan losses for the Dallas region peaked in third quarter of 2011 at 2.11%.

Let's now investigate loan loss allowances in dollar amounts, starting with the Dallas region.

Allowance for Loans and Lease Losses, Dallas

The allowance for loans an lease losses in the Dallas region peaked at $4.412 billion in the third quarter of 2010. It is currently at $3.08 billion.

Allowance for Loans and Lease Losses, All Commercial Banks

The allowance for loans and lease losses for all commercial banks peaked in April 2010 at $235.8 billion vs. $4.4 billion for the Dallas region alone.

Even if fears over energy-related oil losses are a bit overblown, problems are beginning to mount and it's highly likely to spill over into many other sectors of the economy.

The consumer is not doing all that well. Home prices are once again well beyond affordable. Manufacturing is in an outright recession. The rest of the economy is poised to follow manufacturing, or already has.

Turning Point

Declining loan loss provisions are net accruals to earning. Rising loan loss provisions are subtractions from earnings.

Between April 2010 and December 2014 loan loss provisions shrank by $126.8 billion, directly padding bank bottom lines.

In 2015, the decline in loan loss provisions was a mere $2.4 billion.

The real story is not the alleged suspension of mark-to-market rules. Rather, the real story is rising loan and lease loss provisions, across numerous segments, not just energy.

I expect loan loss provisions for housing, construction loans, subprime autos, credit cards, malls, and of course energy, will all rise.

This is a significant turning point. Loan and lease losses have only one way to go: Up. How high remains to be seen, but the effect on earnings won't be pretty.

To top it off, Iran About to Unleash Tidal Wave of Oil Into Depressed Markets.

Mike "Mish" Shedlock

الأحد، 17 يناير 2016

Sanctions Lifted: Iran About to Unleash Tidal Wave of Oil Into Depressed Markets; How Big the Wave?

Futures this evening show Brent Crude is just over $28 a barrel, down another 3.4 percent. At one point futures were $27.67.

Meanwhile, US West Texas Intermediate (WTI) sits at a relatively firm price near $30. The key word being "relatively", not firm.

Sanctions Lifted

The Wall Street Journal reports Iran’s Sanctions End as Deal Takes Effect

I agree, having previously commented "Obama's deal with Iran was the single best thing he has done in eight years".

Warmonger Republicans and Israel would not agree, but most of the world is on my side.

Winners and Losers

The end of sanctions does mean that Iran will be free to sell its oil.

The biggest beneficiary is consumers. The biggest losers are the other oil producing states, the warmongers, and Israel.

Life Worse for Saudi Arabia

Bloomberg says Iran's Oil Will Just Make Life Worse for Gulf Rivals.

The Financial Times reports Oil Industry Braced for Re-Entry of Iran.

On November 15, the Financial Times noted Oil Glut Deepens with 100 Million Barrels at Sea.

If it takes a $6 spread to make a profit in six months, the flotilla buyers barely have it.

September Crude is sitting right about $35 bucks.

Arbitrage profit is declining across the board. And what happens if the tankers cannot unload oil in six months because onshore storage is filled up?

Supertankers Sitting

Supertankers sitting may have fueled the totally inaccurate report that not a single transport ship in the North Atlantic is moving.

My rebuttal was Investigating Claims "North Atlantic Trade Ground to a Halt, No Ships Moving"; The Real Shipping Story.

Tankers are moving, just not very fast.

How Big the Tidal Wave?

Under sanctions, Iran’s crude oil exports have nearly halved in three years according to the US Energy Information Administration.

Those numbers are as of June 2015, reflective of 2014.

Thus, we are looking at an addition of roughly 1.4 million barrels a day, perhaps more if exports shrank in 2015 as well.

Stockpiling is out of the question. Reserves nearly everywhere are full. Ultimately, supply must equal demand.

Barring a supply shock of some sort or a huge cutback in production by other OPEC members, price just may have quite a bit more to fall.

For the short-term, more energy-related pain appears on the horizon.

Mike "Mish" Shedlock

Meanwhile, US West Texas Intermediate (WTI) sits at a relatively firm price near $30. The key word being "relatively", not firm.

Sanctions Lifted

The Wall Street Journal reports Iran’s Sanctions End as Deal Takes Effect

“The EU has confirmed that the legal framework providing for the lifting of its nuclear-related economic and financial sanctions is effective. The United States today is ceasing the application of its nuclear-related statutory sanctions on Iran,” said EU foreign policy chief Federica Mogherini, reading the joint statement.The Guardian reports Lifting of Iran Sanctions is 'a Good Day for the World'.

I agree, having previously commented "Obama's deal with Iran was the single best thing he has done in eight years".

Warmonger Republicans and Israel would not agree, but most of the world is on my side.

Winners and Losers

The end of sanctions does mean that Iran will be free to sell its oil.

The biggest beneficiary is consumers. The biggest losers are the other oil producing states, the warmongers, and Israel.

Life Worse for Saudi Arabia

Bloomberg says Iran's Oil Will Just Make Life Worse for Gulf Rivals.

Governments across the six-nation Gulf Cooperation Council are taking unprecedented measures to counter the slump in oil prices, curtailing some of the world’s most generous welfare systems to plug widening budget deficits. In some countries, contractors are facing delays in government payments, while companies are reducing their workforces to trim costs.Braced for Iranian Oil

Every major stock index in the Middle East, with the exception of Tehran’s, plunged on Sunday as the prospect of Iran adding to an oil supply glut pummeled markets already reeling from falling crude prices and a global sell-off in equities. With oil priced below $30 a barrel, governments may have to eat further into benefits that citizens have enjoyed for decades -- at a time of growing regional turmoil and a proxy confrontation with Iran from Syria to Yemen.

The Saudi Arabian central bank’s net foreign assets fell by $96 billion in the first 11 months of 2015 to $628 billion, and the government sold bonds for the first time since 2007 to finance a budget deficit of about 15 percent of economic output.

“The political contract between the rulers and the citizens is based on a provision of wealth to the citizens, so any adjustment of the subsidies or of the other services will have some political risk,” said Toby Matthiesen, senior research fellow at the University of Oxford and author of “The Other Saudis: Shiism, Dissent and Sectarianism.”

The Financial Times reports Oil Industry Braced for Re-Entry of Iran.

The oil industry is braced for an increase in Iranian production after western powers lifted many of the sanctions linked to its nuclear programme, paving the way for Tehran’s full return to the international market.Oil Flotilla

The re-emergence of Iran, which claims it can swiftly boost production and exports by 500,000 barrels a day, threatens to add to the glut of oil that has pushed prices to a 12-year low of less than $30 a barrel. It comes as relations between Iran and Saudi Arabia, Opec’s largest producer and de facto leader, have soured.

UN inspectors said on Saturday that Iran had dismantled significant elements of its nuclear programme, paving the way for the country to increase exports of its crude to global markets after nearly four years under economic and financial sanctions.

Hassan Rouhani, Iran’s president, on Sunday announced “we have started selling more oil as of today”. But a senior oil official told the Financial Times that there had been no rise in sales yet. “When we say we sell more crude, we mean we already have the capacity to increase exports by 500,000 bpd almost immediately,” he said. “Now, we have customers to buy about 300,000 more barrels per day and will do it as soon as financial restrictions are removed which may take one more week.”

On November 15, the Financial Times noted Oil Glut Deepens with 100 Million Barrels at Sea.

Flotilla Trade

More than 100m barrels of crude oil and heavy fuels are being held on ships at sea, as a year-long supply glut fills up available storage on land and contributes to port congestion in key hubs.

From China to the Gulf of Mexico, the growing flotilla of stationary supertankers is evidence that the oil price crash may still have further to run, as the world’s energy infrastructure starts to creak under the weight of near-record inventory levels.

Sky-high supertanker rates have prevented them from putting more oil into so-called floating storage, shutting off one of the safety valves that could prevent oil prices from falling further.

JBC Energy, a consultancy, said in many regions onshore oil storage is approaching capacity, arguing oil prices may have to fall to allow more to be stored profitably at sea.

“Onshore storage is not quite full but it is at historically high levels globally,” said David Wech, managing director of JBC Energy.

“As we move closer to capacity that is creating more infrastructure hiccups and delays in the oil market, leading to more oil being backed out on to the water.”

Traders looking to make money by storing oil at sea faces a number of challenges. The average daily hire rate for a very large crude carrier has been close to $60,000 a day this year and briefly hit $108,000 last month as producing have scrambled to find customers further afield because of a supply glut estimated at up 2m barrels a day.

Traders estimate it may need to reach $6 to make sea storage viable.

If it takes a $6 spread to make a profit in six months, the flotilla buyers barely have it.

September Crude is sitting right about $35 bucks.

Arbitrage profit is declining across the board. And what happens if the tankers cannot unload oil in six months because onshore storage is filled up?

Supertankers Sitting

Supertankers sitting may have fueled the totally inaccurate report that not a single transport ship in the North Atlantic is moving.

My rebuttal was Investigating Claims "North Atlantic Trade Ground to a Halt, No Ships Moving"; The Real Shipping Story.

Tankers are moving, just not very fast.

How Big the Tidal Wave?

Under sanctions, Iran’s crude oil exports have nearly halved in three years according to the US Energy Information Administration.

Those numbers are as of June 2015, reflective of 2014.

Thus, we are looking at an addition of roughly 1.4 million barrels a day, perhaps more if exports shrank in 2015 as well.

Stockpiling is out of the question. Reserves nearly everywhere are full. Ultimately, supply must equal demand.

Barring a supply shock of some sort or a huge cutback in production by other OPEC members, price just may have quite a bit more to fall.

For the short-term, more energy-related pain appears on the horizon.

Mike "Mish" Shedlock

Economics for Dummies: Reader Asks "Where Do I Start?"

Reader Brad writes: "Hi Mish. I am new to economics. I am not an investor. I have a high school education. I don't understand your blog. Where should I start? Thanks, Brad"

Hi Brad.

Thanks for trying to understand. By trying to learn, I suspect you already know way more than the average person. Here's some reading material that will help.

Recommended Reading List

The first three above are free downloads. Tomorrow's Gold is an investment book by Marc Faber, one of the best ever.

Whatever Happened to Penny Candy?

I have read all of the above. Here's one that I have not read but appears to be worth a read as well: Whatever Happened to Penny Candy? by Richard Maybury.

Penny Candy came up in a search I did while posting the above books. I like the title, but more importantly I like this part of the description: "All explanations and interpretations are according to the Austrian and Monetarist schools of economic theory."

The key word is "Austrian".

Always let your economic thoughts be guided by Austrian theory and your actions by Libertarian principles.

Addendum:

Thanks to reader BR for writing ... Hi Mish. Allow me to recommend 'Economics for Real People' by Gene Callahan, a free download at the Mises Institute: I think this may be better at explaining economic concepts than Hazlitt's 'Economics in One Lesson.'

I have read that book, and I meant for it to be in my list. It's now added above.

Mike "Mish" Shedlock

Hi Brad.

Thanks for trying to understand. By trying to learn, I suspect you already know way more than the average person. Here's some reading material that will help.

Recommended Reading List

- Economics for Real People by Gene Callahan

- Economics in One Lesson by Henry Hazlitt

- What Has Government Done With Our Money? by Murray N. Rothbard

- Case Against the Fed: Murray N. Rothbard

- Tomorrow's Gold Marc Faber

- Capitalism For Kids: Growing Up To Be Your Own Boss by Carl Hess

The first three above are free downloads. Tomorrow's Gold is an investment book by Marc Faber, one of the best ever.